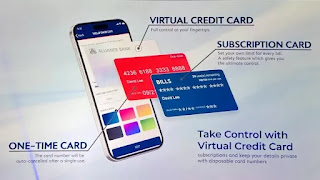

Last April, Alliance Bank introduced a new credit card concept, the Virtual Credit Card or virtual credit card that comes with functions such as dynamic card numbers that are constantly changing for each different transaction.

Users can not only see and monitor the transactions that happen through the application, but with the various issues that various banks are facing now with the data leakage that is happening, the presence of a credit card with this dynamic number feature reduces the risk of your credit card being hacked and taken over.

Alliance Bank started developing this virtual credit card back in 2018, and has collaborated with Red Hat to develop the card's infrastructure in terms of features such as dynamic card number generation, scaling the use of cloud technology and also various ways in which Alliance Bank can get new interested customers. to use this new credit card concept.

Registration for this virtual credit card is also done online through the app, and Alliance Bank says that registrants still go through the same process, but it's all automated and doesn't require any physical interaction with the bank.

Red Hat is seen helping Alliance Bank develop this virtual credit card technology with their open source technology development platform, which is seen to help in terms of keeping their security systems up to date, and tested to ensure that customer data is always secure.

Alliance Bank says that they have plans to digitize other areas of banking such as financial loans, savings and so on, but for now, it still requires a very important human touch.

For now, Alliance Bank's existing credit card customers can easily transfer their account to a virtual credit card account. In the future as well, they will introduce credit card subscriptions with different plans through this virtual credit card system.